The Indian auto sector is experiencing a strong recovery in sales after seeing low demand due to supply chain disruptions.

In 2022, the Indian auto market reported sales of 3.79 million (m) passenger vehicles. This is a growth of 24% compared to 2021.

Growing demand, easing semiconductor chip shortage, and the government's electric vehicle (EV) push were some of the reasons which contribute to this growth.

We all know that hundreds of components, such as battery suspensions, exhaust systems, and axles, are required to make a car.

Along with auto companies, auto component manufacturers are also seeing their sales go up. The demand for auto components is further expected to go up as the government has tightened safety norms for vehicles.

The auto ancillary space presents a much bigger opportunity when compared with the auto sector. But with so many companies competing within the space, which ones are likely to lead the race going forward?

Companies which have shown growth across metrics, say sales, profit, return ratios, and dividend, will have a better chance to compete against their counterparts.

Keeping that in mind, let's take a look at five auto ancillary companies that have registered the highest growth in sales and profit over the past five years.

#1 Sona BLW Precision Forgings

First on the list is Sona BLW Precision Forgings (Sona Comstar).

The company primarily designs, manufactures, and supplies engineered automotive systems, and components.

It has a diversified product portfolio which includes differential assemblies, gears, conventional, and micro-hybrid motors, and electric vehicle (EV) traction motors.

The company designs its products across all vehicle categories. However, with the EV revolution picking up pace, it has increased focus on electric and hybrid vehicles.

As part of its EV portfolio, Sona Comstar designs one-of-a-kind high-power-density EV systems and manufactures EV traction motors. It also manufactures fuel-saving motors for hybrid passenger vehicles.

This has led to several deal wins, including one from a European passenger vehicle maker to supply final drive differential assemblies for their upcoming EV models. It also received 41 EV programs across 25 different customers by the end of December 2022.

In the December 2022 quarter, the company launched one new product in the EV segment taking the total EV product count to fifteen.

It plans to further widen the EV product portfolio across personal and commercial vehicles. In line with this goal, the company has announced a capex of Rs 95 billion (bn) to be spent over the next two years with a focus on light passenger and light commercial vehicles and electric buses.

At present, EV's share is 29% of the revenue. The company plans to increase it to 50% in the next two years by penetrating new geographies and launching new products.

This goal is achievable, given that its order book of Rs 238 bn (as of December 2022) is dominated by EV programs (73%).

In the past five years, the company's revenue has grown at a compound annual growth rate (CAGR) of 28% on the back of high orders. The net profit also grew at a CAGR of 36.5%.

At the end of 2022, the company was debt-free and had an interest coverage ratio of 24.7x. However, with a huge capex outlay for the next two years, debt is expected to go up.

The company's latest return on equity (RoE) and return on capital employed (RoCE) stand at 18.1% and 22.1%, respectively.

Going forward, the government's product-linked incentive (PLI) scheme and growing demand for EVs are expected to drive the revenue and profits of the company.

#2 Rajratan Global Wire

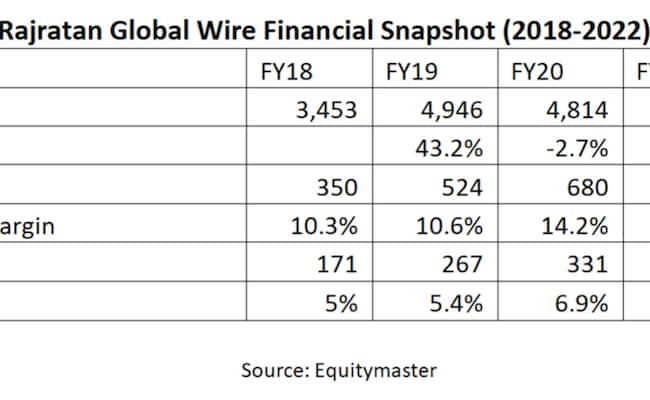

Second on the list is Rajratan Global Wire.

The company manufactures bead wire and steel wire that are used in automobile, aircraft, and earth-moving equipment tyres.

The company has operations in India and Thailand. In India, it has a market share of 50% in the tyre bead wire segment. In Thailand, its subsidiary Rajratan Thailand, is the only manufacturer of bead wire.

It serves customers across India, Thailand, US, South Korea, and Italy. Some of its marquee clients are Apollo Tyres, Bridgestone, Ceat, MRF, Michelin, and Toyo Tyres.

With growing demand, the company is investing heavily to increase its capacity to 132 thousand metric tons per annum (MTPA) from the existing 72 thousand MTPA. The capacity expansion is being done by setting up a new plant in Chennai at the cost of Rs 3 bn.

Besides capacity expansion, the company is concentrating on acquiring new clients in India, Europe, Vietnam, Cambodia, and Malaysia. In line with this goal, it started supplying small sample quantities to its potential customers.

In the last five years, its revenue has grown at a CAGR of 21%, driven by volumes. The net profit has also grown at a CAGR of 48.7% .

Its return ratios have also improved significantly. The RoE grew from 14.9% to 36.5% in the last five years. While its RoCE improved from 27% to 42.6% during the same time.

The company's debt-to-equity ratio was 0.2x as of March 2022, with an interest coverage ratio of 10.9x. The debt-to-equity ratio is expected to go up slightly due to the debt-funded capex.

Going forward, high demand, increasing capacity, and the company's efforts to acquire new clients will drive its revenue and profits.

#3 JBM Auto

Third on the list is JBM Auto.

Established in 1996, the company is engaged in the business of manufacturing auto components such as metal sheet components, tools, dies, and moulds.

JBM Auto has also ventured into manufacturing EV buses in 2018 and is setting up charging stations across the country.

So far, the company has delivered over 1,000 electric buses and installed over 110 fast chargers.

It has invested around Rs 8 bn in EV projects and plans to invest another Rs 6 bn over the next three years to expand its manufacturing capacity from 1,500 buses to 6,500 buses per annum.

The company's electric buses are currently operational in 12 states. It is planning to enter new markets such as J&K, Ladakh, Haryana, Himachal Pradesh, Chandigarh, and Punjab with its newly released models.

JBM Auto has also ventured into the luxury coach market, which is dominated by foreign players.

As of March 2022, the company's revenue from EV buses was Rs 7 bn (22% of the total revenue). It plans to increase it to Rs 10 m by the end of the financial year 2023. Given its order book of 1,066 buses and its plans to expand into new markets, this goal is very much achievable.

In the last five years, JBM Auto's revenue has grown at a CAGR of 15.1%, driven by the growing share of tooling and EV buses venue. The net profit has grown at a CAGR of 18.1% during the same period, on the back of its high-margin tooling business.

On account of heavy capex, the company's debt-to-equity ratio was at 0.5x as of March 2022. However, the company's steady cashflows from repeat customers and long-term agreements ensure adequate liquidity.

Going forward, its established presence in the auto components segment, expansion into new markets, and high demand for EVs will drive its revenue and profit in the medium term.

#4 Sharda Motor Industries

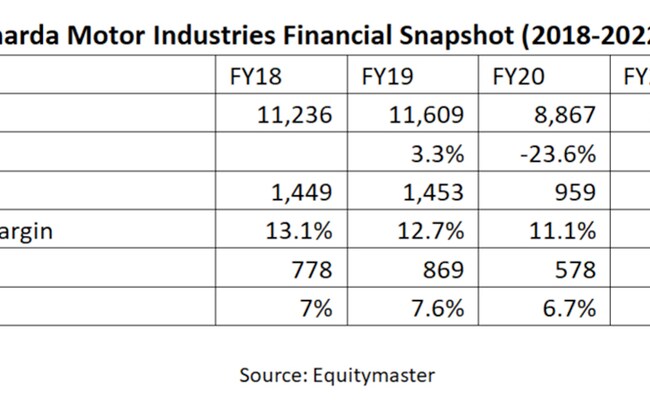

Next on the list is Sharda Motor Industries.

The company is engaged in the manufacturing and assembly of auto components and white goods components.

It has a wide product portfolio consisting of catalytic converters, exhaust systems, suspension systems, sheet metal components, and plastic parts for the automotive and white goods industries.

It has a market share of 30% in exhaust systems and 10% in the suspension systems.

High market share has driven the company's volumes over the years, which is why its revenue has grown at a CAGR of 15.3% in the last five years. The net profit has grown at a CAGR of 15.7% on the back of low costs due to backward integration.

The return ratios are also high, with five-year average RoE of 20.1% and RoCE of 28.3%.

Being a debt-free company gives sufficient headroom to grow as it has sufficient cashflows to fund the capex projects.

In 2021, the company formed a joint venture (JV) with Kinetic Green Energy & Power Solutions to manufacture lithium-ion battery packs for two and three-wheeler EVs and stationary appliances. This marks the company's entry into EV component manufacturing.

After the government announced new emission norms for off-road vehicles, the demand for the company's products has increased, giving it an opportunity to grow the market share.

All these indicate that the company is set to grow dramatically in the long term.

#5 GNA Axles

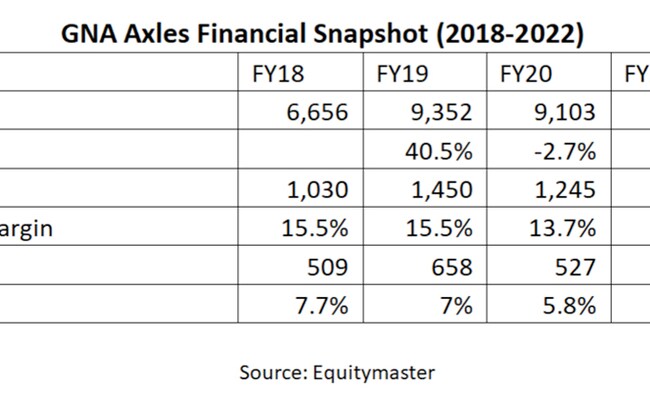

Last on the list is GNA Axles.

The company manufactures auto components such as rear axles, shafts, and spindles for the four-wheeler industry, especially commercial vehicles and has a leading market share of over 50% for majority of its products in the Indian market.

Apart from selling products in India, it also exports to US, Mexico, Australia, Brazil, and Japan.

At present, the company earns majority of its revenue from exports (61%). It plans to penetrate into the Indian markets given multiple tailwinds such as good monsoons and recovery of the tractor market in India.

GNA Axles has also forayed into manufacturing axles for the SUV segment for the export market. This gives the company an additional growth lever.

The company also plans to manufacture axles for the domestic SUV market in the near future.

In the last five years, its revenue has grown at a CAGR of 13.8% on account of the growing share of exports. The net profit has grown at a CAGR of 11.8% due to cost reduction initiatives.

The latest RoE and RoCE stand at 14.9% and 20.5%, respectively. Its debt-to-equity ratio is also low at 0.1x, with a healthy interest coverage ratio of 11.7%.

In the latest quarterly results, the company's revenue grew by 34.3% on account of high demand from the US market. The net profit also grew by 114.4%.

Going forward, growth in US truck market segment and new product developments are expected to drive revenue in the medium term.

Why you should invest in auto ancillary stocks

With the EV revolution picking up pace, auto ancillary stocks look like the perfect proxy play to ride sectoral tailwinds.

The auto ancillary eco-system in India is fairly robust and mature with a large number of companies operating in various niches. Some of these firms are world class. Within the industry, India has a competitive advantage globally in areas such as fasteners, bearings, and shafts.

However, it is important to note that the gains in auto ancillary stocks are linked to the auto industry.

So do your due diligence before investing and consider only the fundamentally strong stocks as the sector is cyclical in nature.

Happy investing!

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such.

This article is syndicated from Equitymaster.com

from NDTV Profit-Latest https://ift.tt/eEvmAgz

No comments: