The dividend season is back!

As the reporting season draws near in India, companies are on track to approve and pay their interim or final dividend to investors in the coming weeks.

Regulatory filings reveal that several firms have already set their record date for dividend payments, indicating the significance of this income stream for both investors and companies.

Dividends serve as a crucial source of passive income for many investors.

These securities are considered a good buffer during times of market volatility. They also are seen as an inflation hedge instrument.

From established blue-chip firms to up-and-coming startups, dividends make the best way to reward their shareholders, even helping the company to shape its image.

With dividend season underway, here are 10 stocks to keep an eye on.

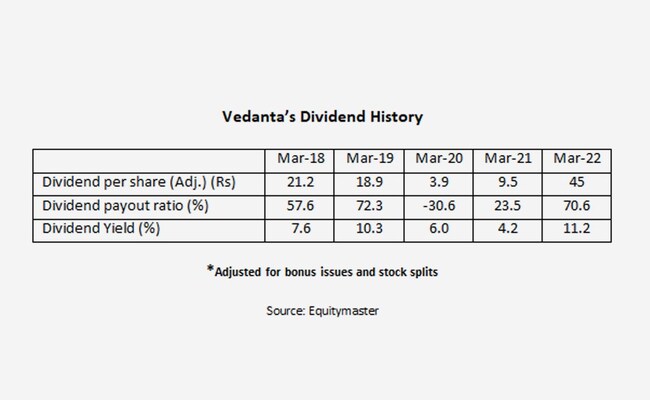

#1 Vedanta

First on the list is Vedanta.

Vedanta is a diverse natural resource company that explores, extracts, and processes minerals as well as oil and gas.

The company tops the chart in the large-cap space with the highest dividend yield of 16.6%.

The five-year average dividend payout ratio stands at 38.7%. The dividend yield over the past five years has averaged 7.9%.

Vedanta has remained a consistent dividend payer. Since 2001, the company has declared 38 dividends.

For the financial year 2022-2023, Vedanta has declared five interim dividends.

The total dividend declared for the year has shot up to Rs 101.5 per share, including the 5th interim dividend.

It's a cash-rich company, Vedanta had cash and cash equivalents of Rs 234.7 bn and a free cash flow of Rs 65 bn as of December 2022 quarter.

While the company has a total debt of Rs 615.5 bn, it has a debt-to-equity ratio of only 0.7x as of December 2022, with an interest coverage ratio of 5.2x.

Considering the cash lying on the books, it could announce a dividend this earning season.

Vedanta's dividend yield is the highest compared to its peers.

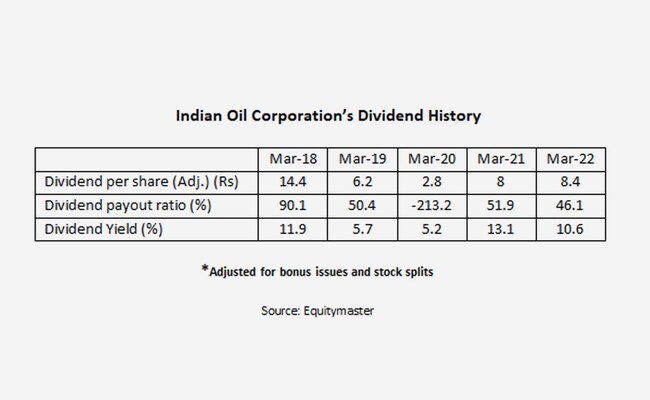

#2 Indian Oil Corporation

Second on the list is Indian Oil Corporation.

Indian Oil Corporation is a Maharatna company controlled by the government of India (GOI). It has business interests straddling the entire hydrocarbon value chain - from Refining to marketing petrochemicals.

The company has a dividend yield of 10.8%.

The five-year average dividend payout ratio stands at 5.1%. The dividend yield over the past five years has averaged 9.3%.

With a good history of dividend payouts, the company has declared 36 dividends since 2001.

For the financial year 2022-2023, Indian Oil has declared two interim dividends.

The total dividend declared for the year stands at Rs 14.5 per share, including the second interim dividend.

As of September 2022 quarter, it had a cash balance of Rs 12.9 bn and a free cash flow of Rs 1.2 m.

While the company has a total debt of Rs 63.6 bn, it has a debt-to-equity ratio of only 1.2x as of December 2022, with an interest coverage ratio of 2.4x.

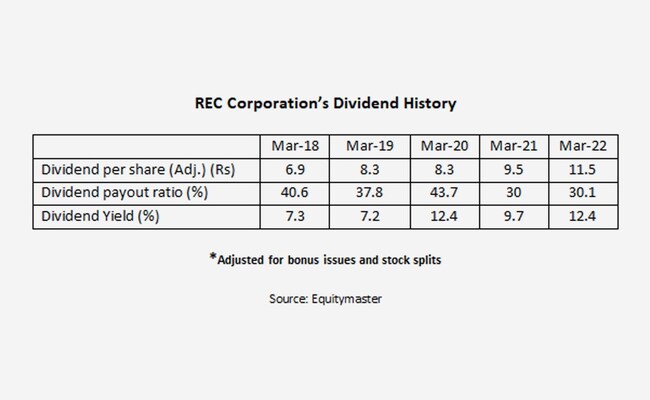

#3 REC

Third on the list is REC.

The company's primary business is to finance projects in the power sector, from power generation to power distribution.

It offers financial assistance to state governments, state electricity boards, independent power producers, and private sector utilities.

REC has a dividend yield of 9.7%. It has the highest dividend yield among the midcaps.

The five-year average dividend payout ratio stands at 36.4%. The dividend yield over the past five years has averaged 9.3%.

The company has been consistently paying dividends to its shareholders since 1998. It has declared 38 dividends since 2008.

For the financial year 2022-2023, REC has declared two interim dividends, resulting in a total dividend payout of Rs 8.5 per share, including the second interim dividend.

Having healthy cash reserves, REC possessed cash and cash equivalents amounting to Rs 2.1 bn, with a free cash flow of Rs 2.7 bn as of December 2022.

As of December 2022 quarter, it had a cash balance of Rs 12.9 bn and a free cash flow of Rs 705 m.

While the company has a total debt of Rs 194 bn, it has a debt-to-equity ratio of only 0.3x as of December 2022, with an interest coverage ratio of 1.6x.

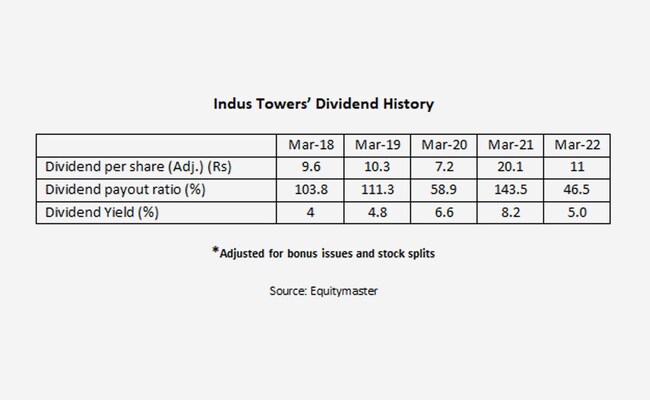

#4 Indus Towers

Fourth on the list is Indus Towers.

Indus Towers is one of the largest digital communications infrastructure providers in the world.

With customers like Bharti Airtel, Vodafone Idea, and Reliance Jio, the company is one of India's leading wireless telecommunications service providers by revenue.

Indus Towers has a dividend yield of 7.8%.

Its five-year average dividend payout ratio stands at 92.8%, while the average dividend yield is 5.8%. The company has declared 16 dividends since 2013.

For the financial year 2022-2023, Indus Towers has declared one dividend of Rs 11.

Its cash and cash equivalents amount to Rs 333 m, with a free cash flow of Rs -9.4 bn as of September 2022.

While the company has a total debt of Rs 333 m, it has a debt-to-equity ratio of only 0.3x, with an interest coverage ratio of 2.3x.

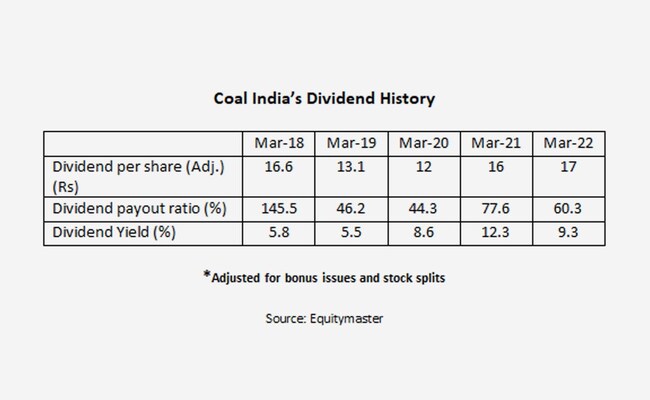

#5 Coal India

Fifth on the list is Coal India.

Coal India (CIL) is an Indian central public sector undertaking (PSU) under the ownership of the Ministry of Coal, Government of India.

It is the largest government-owned coal producer in the world. The PSU contributes around 82% to the total coal production in India.

With its dividend yield of 7.7%, Coal India has emerged as a popular choice among investors seeking dividend-paying stocks.

Its five-year average dividend payout ratio stands at 74.8%, while its average dividend yield is 8.3%.

Coal India has paid 18 dividends (including interim dividends) in the last ten years.

For the financial year 2022-2023, Coal India has declared two interim dividends, resulting in a total dividend payout of Rs 20.3 per share, including the second interim dividend.

Having substantial cash reserves, Coal India possessed cash and cash equivalents amounting to Rs 57.4 bn, with a free cash flow of Rs 2.7 bn as of September 2022.

While the company has a total debt of Rs 37 bn, it has a debt-to-equity ratio of only 0.1x, with an interest coverage ratio of 44.6x.

Given its substantial cash reserves compared to its outstanding debt, there is a possibility that it may declare a dividend during the upcoming earnings season.

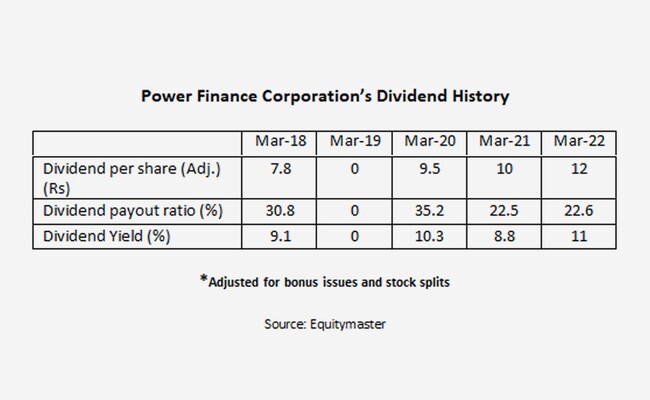

#6 Power Finance Corporation

Sixth on the list is Power Finance Corporation.

Like REC, Power Finance Corporation (PFC) is a non-banking financial corporation (NBFC). It extends financial assistance to Indian power companies.

The company's clients include state electricity boards, power departments, and the private sector.

It has a dividend yield of 7.6%.

The company's 5-year average dividend payout ratio is 22.2%, with an average dividend yield of 7.8%.

PFC has consistently paid dividends since 2007, except for 2019.

Topping the list of most profitable midcaps, it has declared its highest-ever dividend of Rs 12 per share for the year.

Having substantial cash reserves, Power Finance Corporation possessed cash and cash equivalents amounting to Rs 91.4 m as of December 2022.

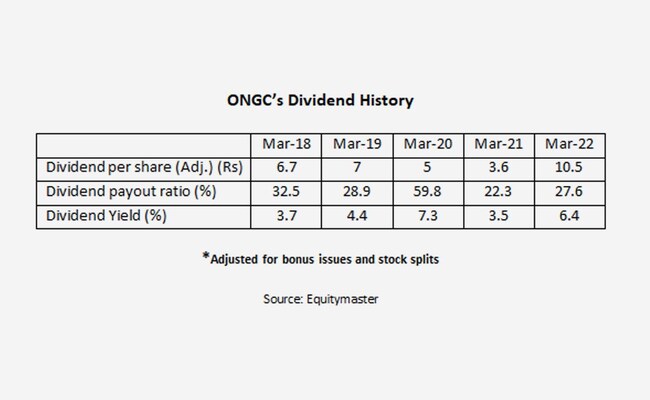

#7 ONGC

Seventh on the list is ONGC.

ONGC is the largest publicly traded oil and gas exploration and production company in India, accounting for 70% of the country's crude oil production, which is nearly equivalent to 57% of the total demand in the nation.

ONGC has a dividend yield of 7%.

It has a dividend yield of a 7.6%.

The company's 5-year average dividend payout ratio is 34.2%, with an average dividend yield of 5.1%.

It has declared 54 dividends since 2000.

For the financial year 2023, it has declared two interim dividends, resulting in a total dividend payout of Rs 10.8 per share, including the second interim dividend.

For the December 2022 quarter, it has a debt-to-equity ratio of only 0.1x as of December 2022, with an interest coverage ratio of 184.8x.

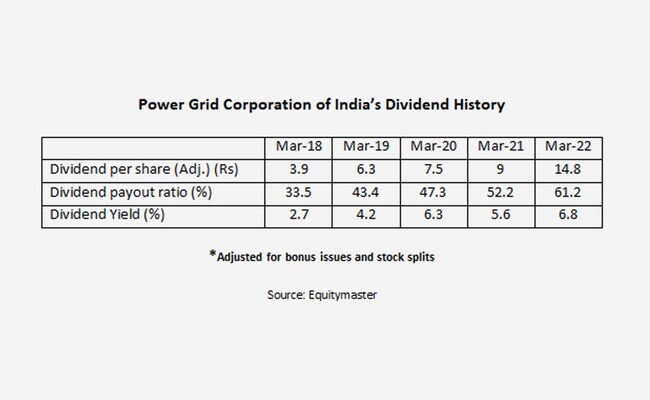

#8 Power Grid Corporation of India

Eight on the list is the Power Grid Corporation of India.

Established in 1992, Power Grid is among the biggest public-sector undertakings (PSUs) in India. Despite its modest origins, the company has expanded rapidly to meet the country's insatiable demand for electricity.

It has a dividend yield of 6.6%.

The company's 5-year average dividend payout ratio is 47.3%, with an average dividend yield of 5.1%.

Along with having a monopoly status, the company has rewarded its shareholders with hefty dividends over the years. It has paid 29 dividends since 2011.

Power Grid has declared two interim dividends for the financial year 2023, resulting in a total dividend payout of Rs 10 per share, including the second interim dividend.

As of December 2022 quarter, it had a cash balance of Rs 27.9 bn and a free cash flow of Rs 751 m.

While the company has a total debt of Rs 1.2 tn, it has a debt-to-equity ratio of 1.6x as of December 2022, with an interest coverage ratio of 3.3x.

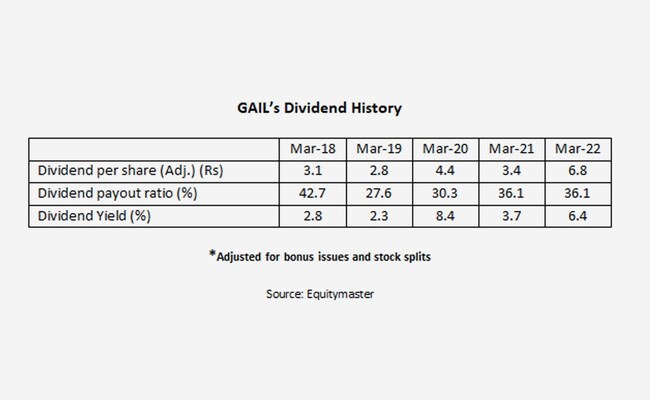

#9 GAIL

Ninth on the list is GAIL.

GAIL India, a government of India undertaking, is an integrated natural gas company in India.

The company is an integrated energy company along the natural gas value chain, with a global footprint. It's in the business of natural gas, liquid hydrocarbons, and petrochemicals.

GAIL has a dividend yield of 6.4%.

Over the past five years, it has had an average dividend payout ratio was 34.5% and an average dividend yield of 4.7%.

GAIL has paid 46 dividends since 2001. For the financial year 2023, it has paid two interim dividends amounting to Rs 5 per share.

As of September 2022 quarter, GAIL had a cash balance of Rs 2.7 bn and a free cash flow of Rs 751 m.

While the company has a total debt of Rs 8.7 bn, it has a debt-to-equity ratio of 0.2x as of December 2022, with an interest coverage ratio of 29.1x.

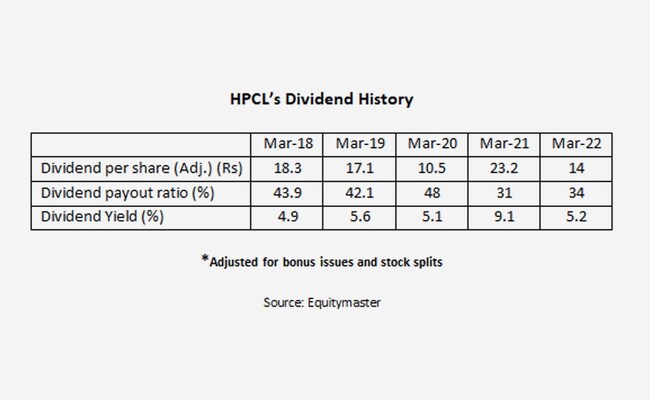

#10 Hindustan Petroleum Corporation (HPCL)

Last on the list is Hindustan Petroleum Corporation (HPCL).

HPCL is one of India's leading oil marketing companies, with a market share of 21%. It's an integrated refinery and petroleum marketing company.

The company has a refining capacity of over 15 million metric tonnes per annum (MMTPA) in its Mumbai and Visakhapatnam plants which are running at a utilisation rate of above 100%.

It has a dividend yield of 6.1%.

Over the past five years, it has had an average dividend payout ratio was 39.8% and an average dividend yield of 5.9%.

HPCL has paid 33 dividends since 2000. For the financial year 2023, it has paid a dividend of Rs 14.

As of September 2022 quarter, GAIL had a cash balance of Rs 2.3 bn and a free cash flow of Rs 5.5 bn.

While the company has a total debt of Rs 410.7 bn, it has a debt-to-equity ratio of 2.8x as of September 2022, with an interest coverage ratio of -1.4x.

Conclusion

In the past year, rising rates and hot inflation turned the market upside down, with investors ditching highflying companies for overlooked stocks like dividend-payers that offer greater stability.

This has proven to investors once again why dividends are so important in a volatile market. They provide investors with a steady income and a moderate return on their investment.

Companies paying out a slice of their earnings to shareholders typically have a record of strong profits, an appealing trait as investors worry elevated costs and strapped consumers could dent corporate results.

Whether seeking short-term gains or long-term growth, dividends offer a reliable and compelling means of realizing one's financial goals.

This is why dividend-paying stocks have been shown to have higher returns than non-dividend-paying stocks over long periods.

If you are interested in investing in dividend stocks, you should investigate the company's history of dividend payments and their value before investing.

Also, if you want to dig deeper, use Equitymaster's stock screener to check high dividend yield stocks and the best dividend stocks to buy.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such.

This article is syndicated from Equitymaster.com

(Except for the headline, this story has not been edited by NDTV staff and is published from a syndicated feed.)

from NDTV Profit-Latest https://ift.tt/LPm7eAE

No comments: